Understanding the Cycle of Gambling Debt

Gambling debt recovery often begins by confronting a cycle of denial, secrecy, and emotional distress. For many, the debt doesn’t appear overnight—it builds silently through repeated attempts to “chase losses.” Over time, people may avoid checking bank balances, isolate from loved ones, or spiral into guilt and anxiety.

But here’s the truth: this cycle can be broken. Gambling debt recovery starts with clarity, courage, and the right support systems.

NOTE: Some of the links on this page are affiliate links. That means if you choose to make a purchase, High Stakes Healing may earn a small commission—at no extra cost to you. We only recommend books and resources we believe can truly support your recovery journey.

First Steps Toward Gambling Debt Recovery

1. Acknowledge the Debt Without Shame

Start by writing down all outstanding debts—credit cards, payday loans, personal loans, or money owed to friends and family. This is not self-punishment—it’s an essential step in the gambling debt recovery process. Shame keeps debt hidden. Naming it is your first act of financial self-respect.

Your Personal Finance Ally

Don’t let past gambling define your financial future. With PocketSmith, you can regain control of your money and rebuild with confidence.

2. Prioritize Essential Expenses

Before tackling lump-sum repayments, make sure your basic needs—like rent, food, healthcare, and utilities—are met. These priorities protect your well-being as you begin your recovery journey.

3. Avoid Impulsive Repayment Decisions

Don’t rush to pay off large chunks in a panic. Gambling debt recovery is a long game. Quick fixes often cause more harm than good. Before making major financial moves, consider speaking with a financial advisor or counselor.

Smart Debt Management Strategies

Consolidate High-Interest Debt

One useful gambling debt recovery tactic is debt consolidation. Rolling multiple high-interest balances into a single loan with better terms can simplify your payments and reduce emotional overwhelm.

Seek Professional Financial Counseling

Certified counselors can help you:

- Create a manageable repayment plan

- Negotiate with creditors

- Set realistic goals

Many organizations offer free or low-cost financial help for those recovering from gambling-related issues.

Use Budgeting and Tracking Tools

Budgeting apps like You Need a Budget (YNAB) or EveryDollar help you stay accountable. These tools empower you to regain financial control and establish structure—critical parts of gambling debt recovery.

Explore Lender Hardship Programs

Banks and lenders often provide options like payment deferrals, extended terms, or lower interest rates during times of hardship. Being proactive shows commitment to recovery and can open new pathways toward relief.

Emotional Healing Is Part of Gambling Debt Recovery

Gambling debt recovery isn’t just financial—it’s emotional. Shame, regret, anxiety, and self-blame can feel heavier than the numbers on a statement.

Personalized Help for Recovery

Every recovery story is unique. With Online-Therapy.com, you’ll get personalized plans, worksheets, and access to licensed professionals who understand the challenges of gambling addiction.

Healing the emotional wounds from gambling debt is just as important as clearing the debt itself.

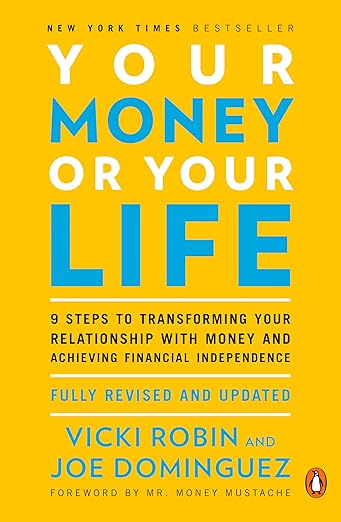

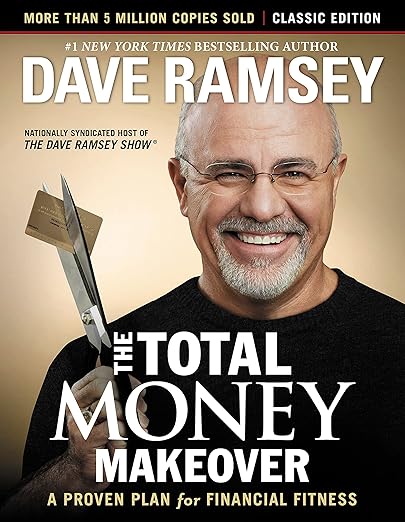

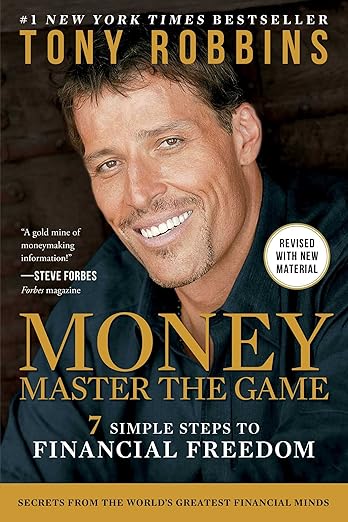

Books That Support Gambling Debt Recovery

Take Back Financial Control

For many people, gambling leaves behind financial scars. With the right tools and books, you can take control of debt and build a healthier financial future. Visit our collection of financial recovery books to create stability beyond gambling.

Podcasts That Explore Gambling Debt and Healing

- All Bets Are Off – Real stories of people overcoming gambling debt.

- The Ambitious Addicts Podcast – Focuses on mindset shifts and rebuilding financial confidence.

- Fantasy or Reality: The GPP – Talks on debt, relapse, and long-term healing.

Final Thoughts on Gambling Debt Recovery

Gambling debt recovery isn’t just about paying bills—it’s about reclaiming peace, dignity, and confidence. Each step you take, no matter how small, is a powerful declaration that you are more than your past mistakes.

You are capable of rebuilding. You deserve support. And your future can be debt-free, emotionally stable, and hopeful.

A Gentle Step Forward

- Subscribe to our newsletter for weekly support and recovery tools

Frequently Asked Questions on Gambling Debt Recovery

Can gambling debt ever truly be repaid?

Yes. With a structured repayment strategy, lifestyle adjustments, and emotional support, most people can overcome even significant gambling debt. It starts with clarity, not perfection.

Should I tell my family about my gambling debt?

If your debt impacts shared resources or the relationship, honesty can support healing. You might consider talking to a counselor first to plan how to share the news constructively and compassionately.

What should I prioritize: debt repayment or covering basic needs?

Basic needs—like rent, utilities, and healthcare—should come first. Once you’ve secured essentials, you’ll be in a more stable place to tackle your debt strategically and sustainably.

Is debt consolidation a good idea for gambling recovery?

It can be. Consolidating multiple high-interest debts into a single, more manageable payment can reduce stress and simplify your budget. Just make sure the consolidation terms are truly cheaper or easier to manage in the long run.

Where can I find emotional healing while recovering from gambling debt?

Emotional healing matters just as much as financial recovery. Consider online therapy, support groups like Gamblers Anonymous, or holistic programs such as Pressure Relief Programs. These can help address shame, anxiety, and guilt.

Final Thought

Your debt does not define you. It reflects pain you were trying to manage—and now, healing you’re brave enough to choose.

Recovery isn’t about perfection. It’s about honesty, progress, and showing up today with hope.

You are not alone. You are not beyond help. You’re already on your way.

Start Your Healing Journey

If you’re ready to start your own recovery, follow your personalized path to gambling recovery and long-term growth.

Next Steps on Your Recovery Journey

- Budgeting After Addiction to Support Long‑term Recovery

- Financial Recovery After Gambling: Lessons in Resilience and Renewal

- Practical Gambling Recovery Toolkit

Join the High Stakes Healing Community

Subscribe to our newsletter for exclusive tools, honest stories, and compassionate resources tailored for gambling recovery. Join the High Stakes Healing recovery community.