A Powerful Path to Rebuilding Life After Gambling

In the journey of gambling recovery, many people focus on stopping the habit itself. But long-term healing goes beyond abstaining from bets—it’s about regaining your sense of stability, safety, and purpose. One of the most overlooked yet transformative aspects of this process is financial stability and emotional recovery.

Money and emotions are deeply intertwined. The highs and lows of gambling create patterns of fear, excitement, and shame that can linger even after the betting stops. Relearning how to manage your finances with awareness becomes not only a practical necessity but a profound act of emotional healing.

Note: Please note that some links in this article are affiliate links. If you choose to use them, we may earn a commission with no added cost to you. We are committed to recommending resources that uphold the values of safety, honesty, and long-term recovery.

The Connection Between Financial Stability and Emotional Recovery

When someone rebuilds their financial situation, they aren’t just paying off debts or saving money—they’re rebuilding trust in themselves. Each financial decision becomes a mirror reflecting emotional growth, resilience, and clarity. This is why financial stability and emotional recovery often develop side by side.

Emotional recovery begins when we stop viewing money as a measure of worth and start seeing it as a tool for alignment. By tracking your finances and setting clear goals, you create a sense of structure and predictability—the very things that gambling once disrupted. Over time, this structure restores inner calm and self-assurance.

Featured Book Review

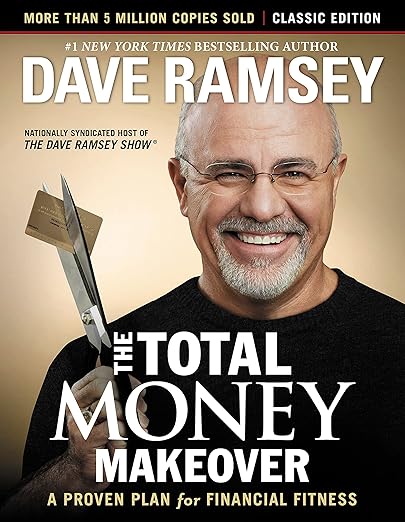

The Total Money Makeover by Dave Ramsey

The Total Money Makeover by Dave Ramsey

A straightforward and motivating guide to rebuilding financial stability, Ramsey’s bestselling book outlines a step-by-step plan for eliminating debt, building savings, and gaining long-term control over your money. Its practical structure makes it especially helpful for anyone recovering from gambling-related financial damage and needing a clear, structured path to restore financial health.

Recovery takes guidance, and books can provide both comfort and practical strategies. Visit our Books for Healing and Recovery collection to explore guides, memoirs, and workbooks that support lasting change.

Rebuilding a Sense of Control

In the early stages of recovery, it’s common to feel overwhelmed by financial uncertainty. Bills may have piled up, credit scores may have dropped, and budgeting may seem like a reminder of past mistakes. But here’s where healing truly begins—with small, intentional steps toward clarity.

Creating a simple budget isn’t just about numbers; it’s about creating emotional safety. Every transaction you record, every plan you set, sends a quiet message to yourself: “I am in charge again.” These mindful acts strengthen the connection between financial stability and emotional recovery, building confidence one decision at a time.

Healing Emotional Triggers Around Money

After gambling, money can become emotionally charged. Even checking your balance might trigger anxiety or guilt. Healing requires reframing your relationship with money as a neutral and supportive presence in your life. When you view your finances with curiosity instead of fear, you begin to loosen the grip of shame.

This emotional reframing is at the heart of financial stability and emotional recovery. It allows you to see money not as a source of power or failure, but as a reflection of your evolving values. With compassion, patience, and consistency, you begin to trust yourself with money again.

Take Control of Your Finances

Gambling often leaves financial confusion behind. PocketSmith helps you organize your money, track debt, and plan ahead with clarity. It’s a powerful step toward rebuilding stability in recovery.

Tools That Support Financial Awareness and Healing

To strengthen the connection between financial stability and emotional recovery, it helps to use tools that make money management visual, flexible, and intuitive. By practicing mindfulness for financial stability, you not only track numbers but also cultivate awareness of spending habits, emotional triggers, and long-term goals. This approach turns budgeting into a healing practice—one that aligns financial choices with recovery values and builds confidence step by step. This is where mindful planning platforms can make a difference.

When paired with recovery practices like journaling and reflection, tools like PocketSmith can transform financial planning into a form of self-care. You’re not just balancing budgets—you’re rebuilding trust, confidence, and foresight. Each small act of organization strengthens both financial stability and emotional recovery.

Patience and Progress Over Perfection

Healing from gambling addiction takes time, and so does rebuilding your financial foundation. Progress might feel slow, but every choice you make toward stability is a step away from chaos and toward peace. Tracking that progress can serve as tangible proof that you’re growing—even when it feels invisible.

Remember, there’s no single roadmap for financial stability and emotional recovery. Some days, it might mean reviewing your budget; other days, it’s simply choosing not to panic when plans shift. The goal isn’t perfection—it’s awareness, adaptability, and kindness toward yourself as you move forward.

Reconnecting With Purpose Beyond Money

As stability returns, it’s easy to get caught up in the numbers. But true recovery means seeing beyond them. The ultimate purpose of financial stability and emotional recovery is not wealth—it’s freedom. It’s the ability to live a life aligned with your values, foster meaningful relationships, and achieve peace of mind.

Money becomes a tool for expansion rather than escape. With each responsible decision, you reclaim your right to dream again, to build something lasting, and to live without the shadow of your past controlling your future. Budgeting after addiction to support long‑term recovery becomes part of this transformation, turning financial planning into a daily act of resilience. Each budget choice reinforces stability, protects against relapse, and opens the door to building a future rooted in confidence rather than fear.

Final Thoughts: Financial Healing as Emotional Healing

In gambling recovery, learning to manage money is deeply emotional work. It’s about reconnecting with yourself after a period of disconnection. The balance sheets and budgets are symbols of something larger: integrity, presence, and self-trust. Every mindful choice you make brings you closer to lasting peace.

If you’re ready to explore a new way to understand your finances and rebuild confidence, start small—track your spending, visualize your goals, and celebrate progress. Over time, you’ll discover that financial stability and emotional recovery are two sides of the same healing journey.

Related Reading on High Stakes Healing

- Talking to Your Spouse About Gambling Debt with Honesty and Care

- Compassionate Strategies for Helping Someone with Gambling Addiction

- Gambling Debt Recovery Guide

Your Support Resources in One Place

Whether you need therapy, budgeting help, mindfulness support, or reading material — our Recovery Tools & Resources page gathers all recommended tools to help you rebuild with clarity and purpose.